BitSpreader Crypto Spread Trading

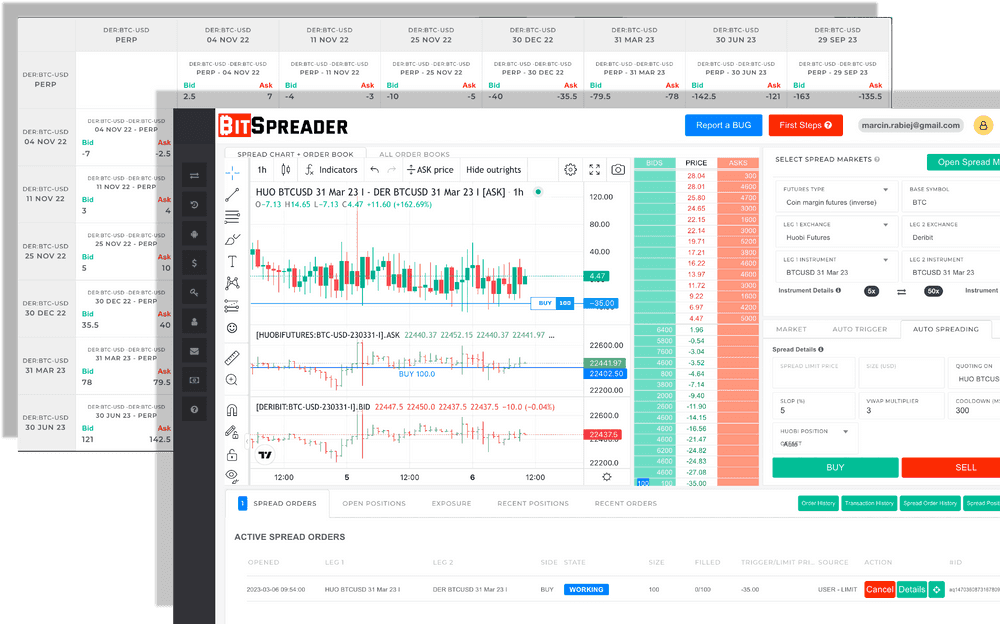

intra and cross-exchange spreads

- implied orderbooks composed in real time

- intra and cross-exchange spread positions managementAuto - spreading

Low latency, high-frequency spread trading method realised with use of limit orders (market making)

Advanced Spread Charts

We gather real time spread data that we provide to you for

historical analysis.

Trade on

over 120 synthetic

cross-exchange calendar spreads!

Over 120 synthetic intra and inter exchange calendar spreads. We still adding new integrations to make our portfolio richer.

| Market | BID | ASK |

|---|---|---|

| Binance:BTC 29Mar24 - Binance:BTC PERP | - | - |

| Binance:BTC 29Mar24 - Deribit:BTC 29Mar24 | - | - |

| Deribit:BTC 29Mar24 - Deribit:BTC Perp | - | - |

| Binance:BTC-USDT-PERP - Deribit:BTC-USDC-PERP | - | - |

| Deribit:BTC PERP - Huobi:BTC 29Mar24 | - | - |

| Binance:BTC-USDT PERP - Huobi:BTC 29Mar24 | - | - |

FAST AND RELIABLE

It is fast and reliable, our cloud-based infrastructure assures low latency and short execution times

WELL DOCUMENTED

Documentation included with explanations for most of the options.

TRADE AUTOMATION

BitSpreader will execute your spread orders automatically based on provided criteria

EXPOSURE MANAGEMENT

Manage your outright exposure in case any of the legs can't be executed

INTEGRATIONS

High standard of performance and error handling, growing base of integrated exchanges

BOTS ARE COMING

We are working on even more automation with custom trading strategies

IMPLIED ORDER BOOK

Real time constructed and streamed implied cross-market order book

DETAILED AUDIT TRAIL

BitSpreader allows for the real time monitoring of each order execution

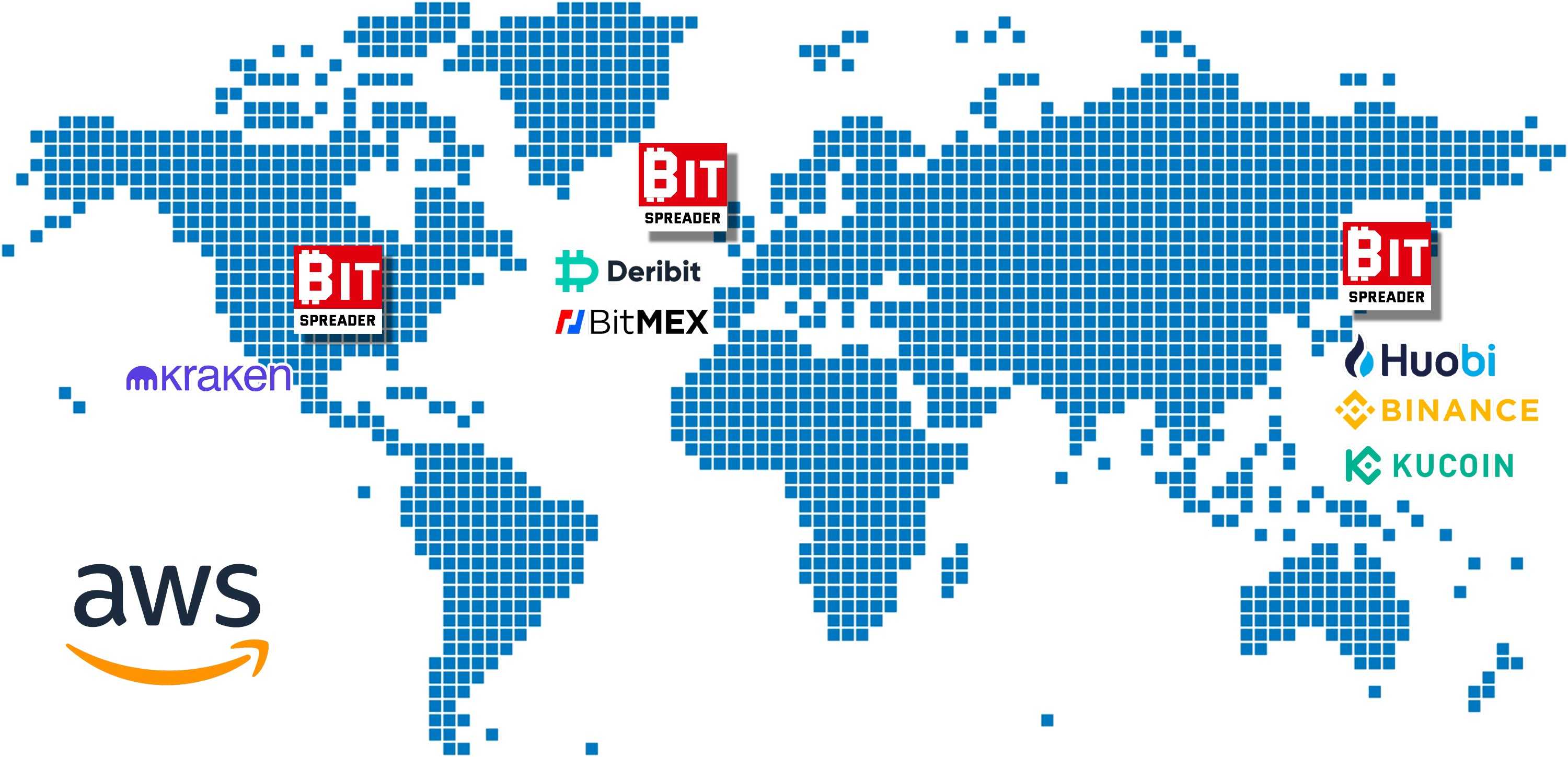

Geographical

Co-Location for

Lightning-Fast Execution Times!

BitSpreader now offers geographical co-location of servers, providing traders with the fastest possible execution times. By strategically placing servers across the world in the United States, Europe, and Japan, users can now choose the location that guarantees the best execution times for their trades. This new feature is designed with the needs of serious traders in mind, ensuring minimal risk of slippage and maximum profits. With BitSpreader's geographical co-location, you can take your trading to the next level and trade with confidence.

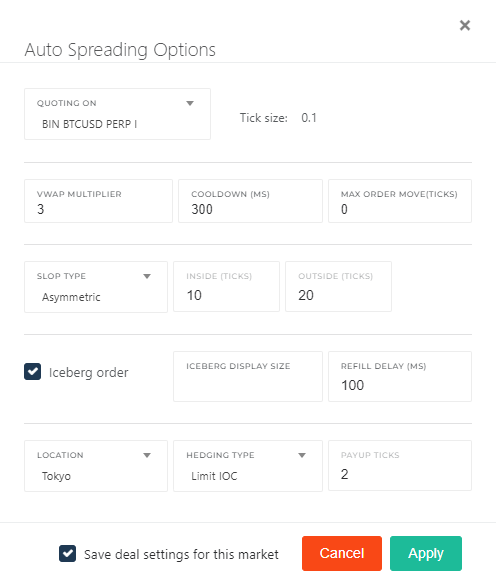

AutoSpreading

HIGH FREQUENCY TRADING

BitSpreader actively places and updates limit order on one side and hedges with the market order on the other side

Speed & Lower fees

Suitable for catching short lasting spreads and assure lower transaction costs

YOUR SECURITY is very important to us

We never touch your funds

Your funds are stored safely on your exchange account, BitSpreader just executes orders on your behalf on the exchange using the API key that you have provided.

BitSpreader never does any transfers of your funds.

For further increase of security we strongly encourage you to not provide any API keys that have privilege to execute transfers - please refer to your exchange API key settings to make sure to reduce the API key privileges just to the most necessary (balance, history, trading).

Your data is encrypted

Your API keys are encrypted with highest security standards and available only in the internal layer of the BitSpreader services safely hidden behind the firewalls and not accessible from the website. Encryption keys are safely stored in the digital vault.

For managing your API keys we follow write-only pattern - once you have provided your API key, the BitSpreader has stored it internally for the trading purposes and doesn't expose it even to you for editing. If you need to update the API key - you need to delete the old key and provide the updated one. This approach secures your keys in case you lose access to your BitSpreader account.

Two Factor Authentication is a MUST

In order to further increase your security we require ALL the users to use two-factor authentication. Every time you sign in to the platform you need to provide security code generated by the two-factor application on your mobile phone - ie Google Authenticator or FreeOTP that needs to be set up during the registration process.

INTEGRATIONS