QUESTIONS? EMAIL: contact@bitspreader.com

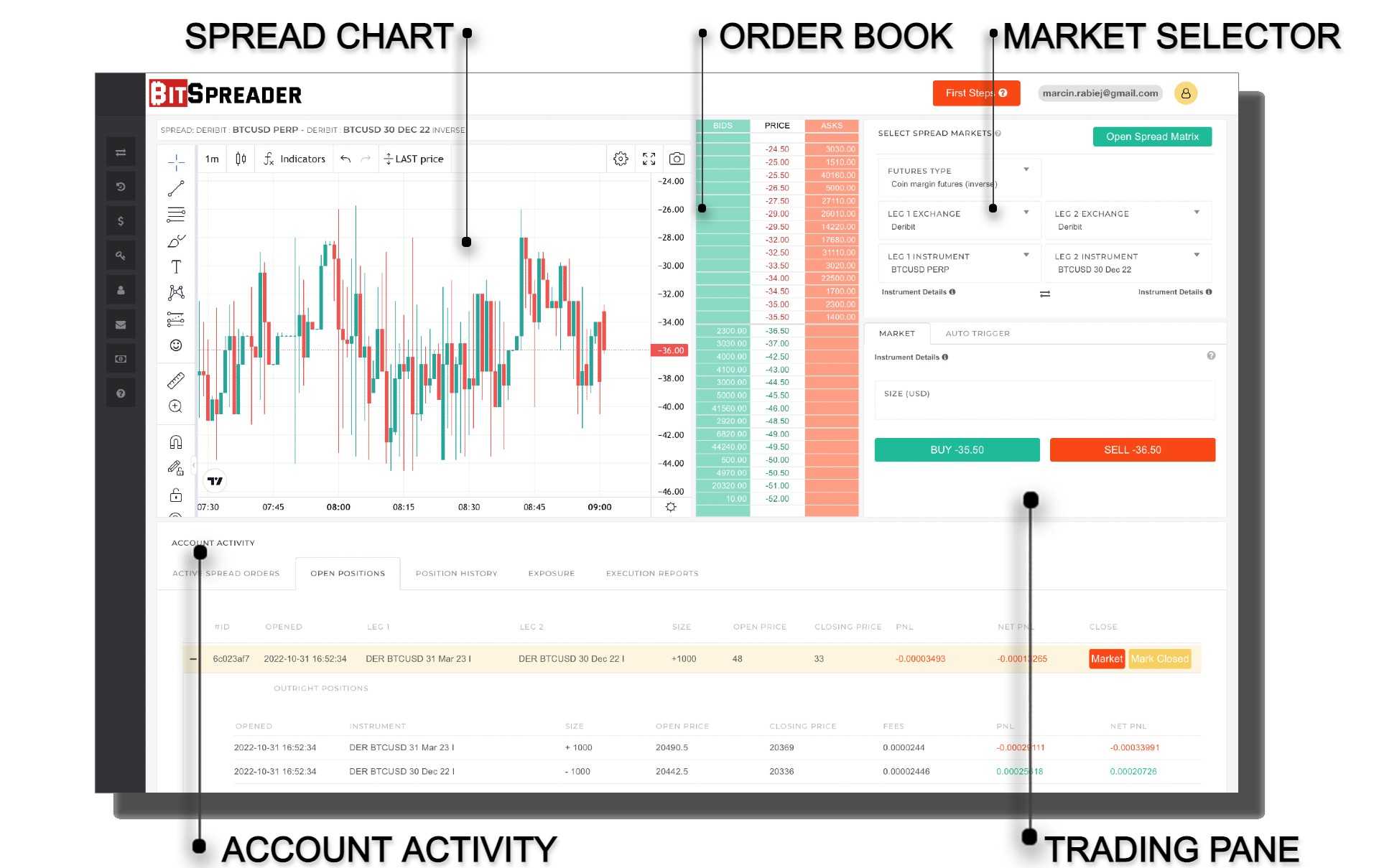

Trading Basics

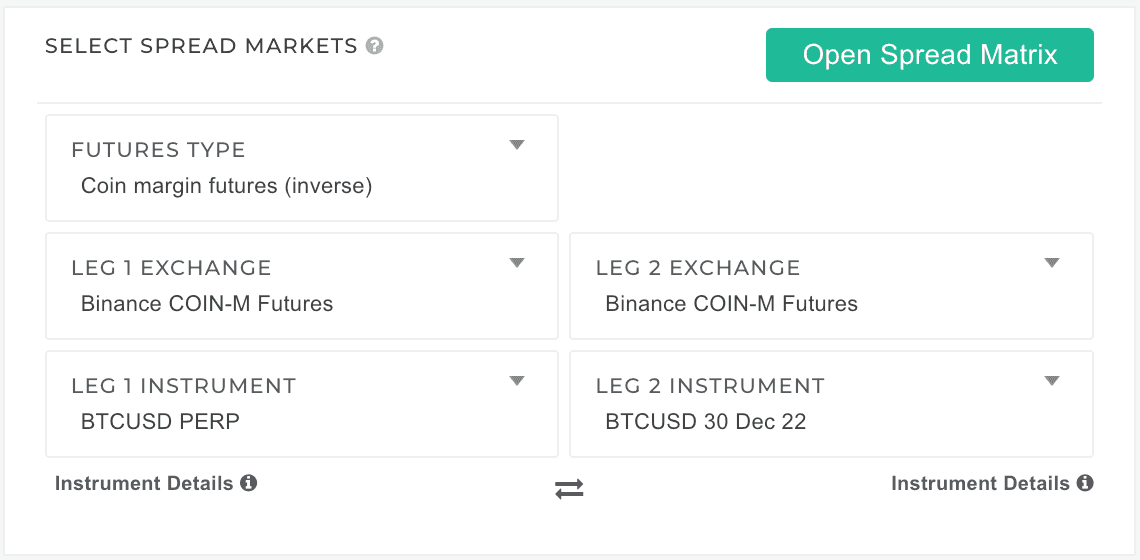

1. Select the spread

Take a look at the documentation of the Spread Market Selector HERE

- select futures type

- select leg 1 exchange and market

- select leg 2 exchange and market

You can also use Spread Matrix to select the spread for trading

2. Prepare funds for margin

BitSpreader currently does not control your margin and does not do any validations against available funds before placing the spread order.

Before placing an order you must assure free margin on your account. BitSpreader does not control positions that you have opened directly on the venue and doesn't check your available margin. Make sure you provide enough available funds on both markets of selected spread to cover the margin of the positions you want to open.

You can check available funds in the Balances service in BitSpreader available in left sidebar. Refer to the exchange specific documentation to understand how to make sure you have funds available for trading.

In case any of the legs of the spread could not be executed due to lack of funds, you will end up with the exposure - only one leg of the spread will be traded. You can find your exposure in the Account Activity>Exposure tab

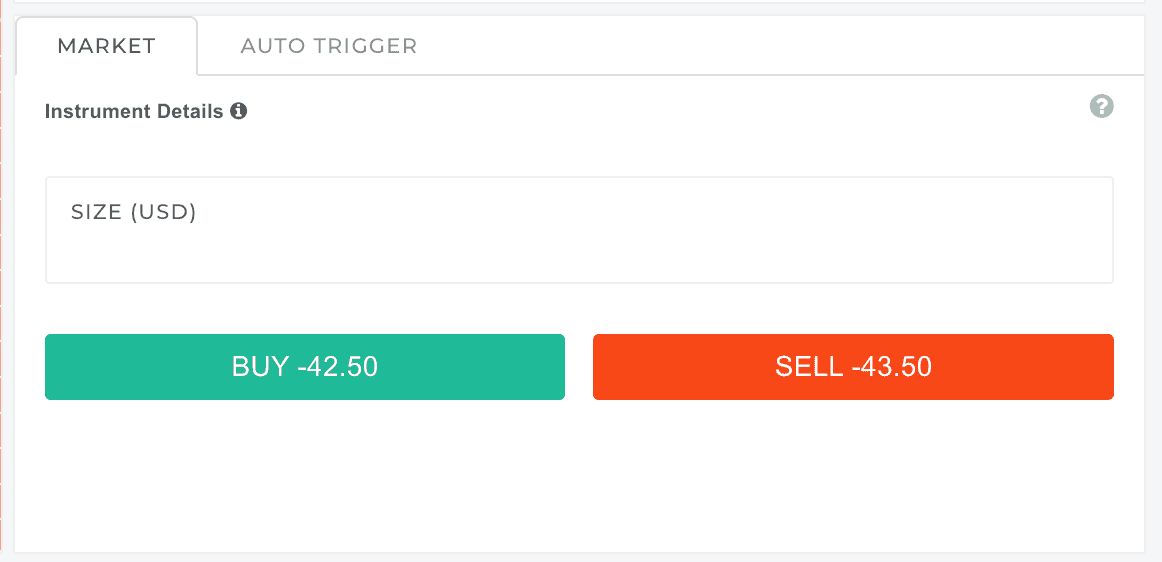

3. Place order

Provide:

- size - size of each outright contract

- BUY spread means: BUY LEG 1, SELL LEG 2

- SELL spread means: SELL LEG 1, BUY LEG 2

Restrictions and Validation: please refer to the Spread Market Details section for reference

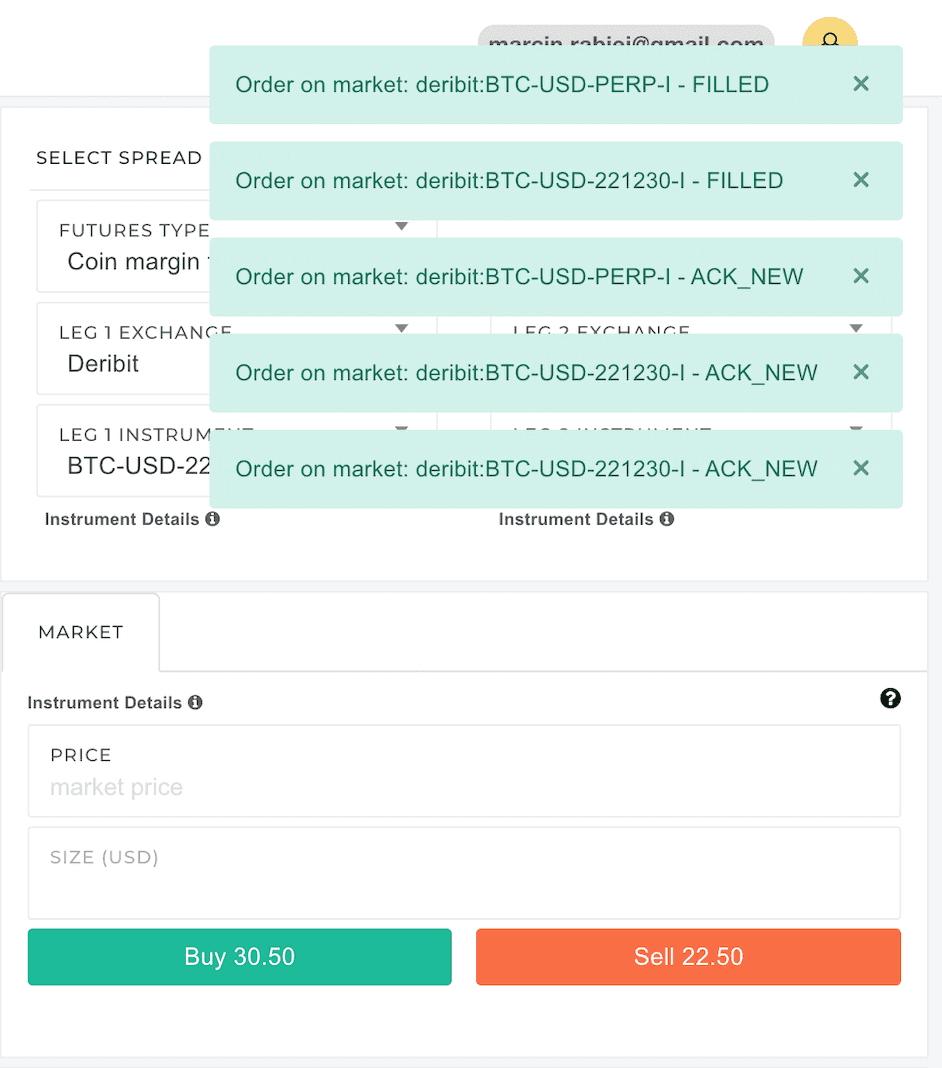

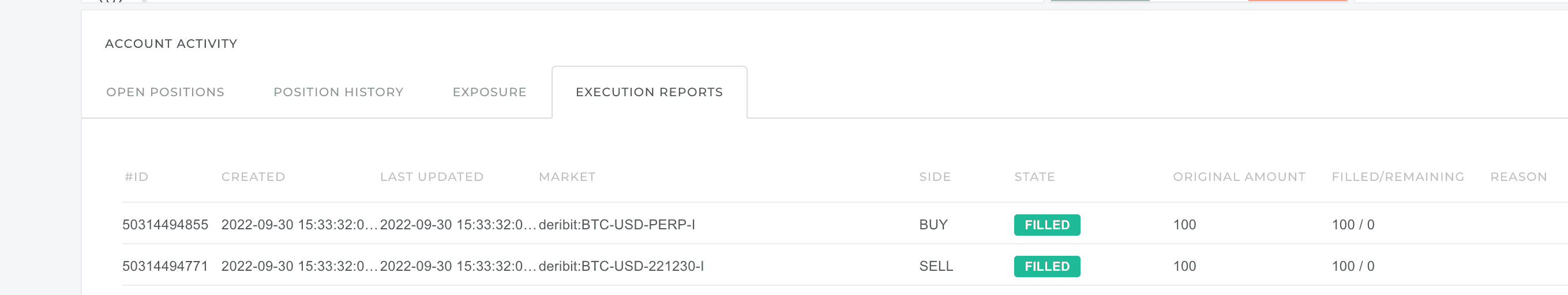

4. Check execution

After clicking BUY/SELL you will receive stream of notifications with execution results

You can review the results of the individual trades in the Account Activity>Execution Reports Tab.

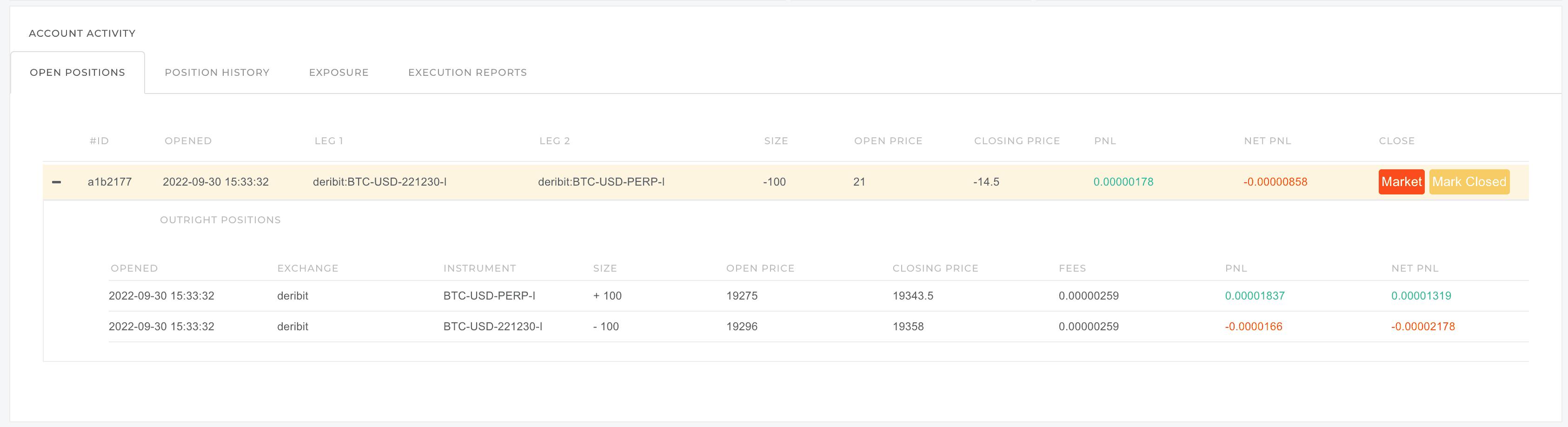

5. Check open positions

6. Close Position

You can close the position by clicking Market button next to the position - that will be equivalent to issuing the spread order with the same size as the position but opposite direction.

Alternatively you can manually enter the size and issue the opposite direction trade. Your position will be closed and you will be able to find it in the Closed Positions tab.