Introduction to futures spread trading

Crypto spread trading on futures is trading strategy where the traders profits from the change in the price differences - the spread price - between two positions - short and long - on the two futures contracts that have the same underlying asset with different delivery dates, or on the two futures contracts with different underlying assets that are price correlated to each other with the same delivery date.

You can find full introduction to cryptocurrency futures spread trading in our Medium article here: Futures Spread Trading

Spread is the price difference between two futures contracts. The price of the each futures contract is formed by the market based on the market participants' expectations/calculations. As each futures contract is traded on separate market with different liquidity, the price volatility of each contract differs, resulting in changes in the spread price.

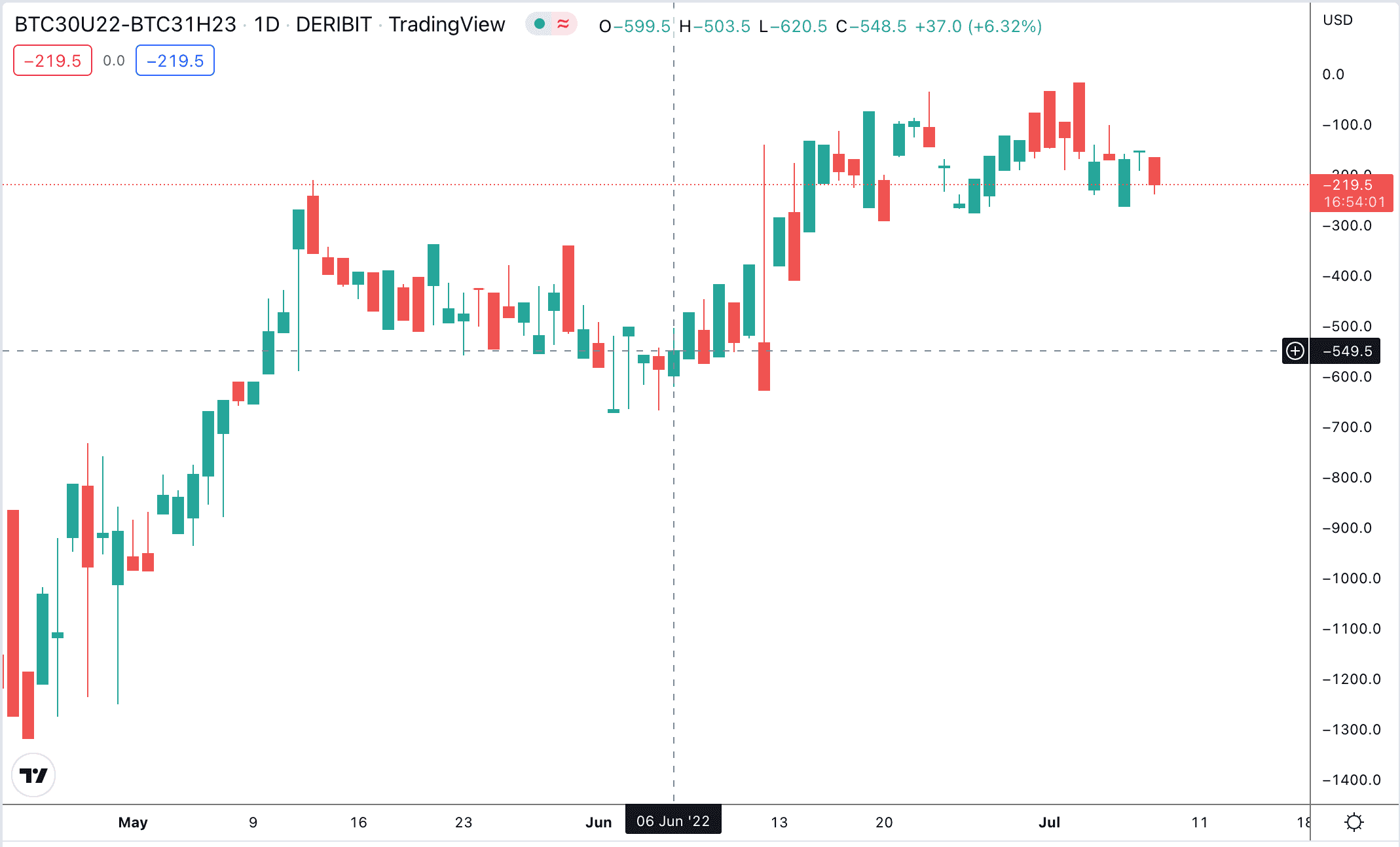

An example of the spread price changing through the time

In order to profit we buy the spread, when the spread price is low and we sell the spread when its price is high. Or if we think that current spread price is high and we think it is going to fall, we sell the spread and we buy it back when the price has fallen.

Intramarket spreads, also referred to as calendar spreads, involve buying a futures contract with delivery date in one month while simultaneously selling the contract on the same underlying asset with the delivery date in a different month. In most cases, there will be a loss in one leg of the spread, but a profit in the other leg. If the calendar spread is successful, the gain in the profitable leg will outweigh the loss in the losing leg.