Futures Spread Trading terminal

Smooth spread trading experience

Trade on cross-exchange calendar spreads

Trading Terminal

BitSpreader Trading Terminal allows for smooth execution of spread trades, tracks users spread positions and allows for monitoring and active management of the exposure.

Calendar spreads - BitSpreader supports spreads constructed from two legs - two outright futures contracts. Traders can choose to trade on two outright contracts with the same underlying instrument but with different delivery dates.

Basis trading - For the purpose of basis/cash and carry trading we support perpetual futures contracts. Users can engage in basis trading by constructing the spread that consists of one contract with defined delivery date and second that is perpetual contract.

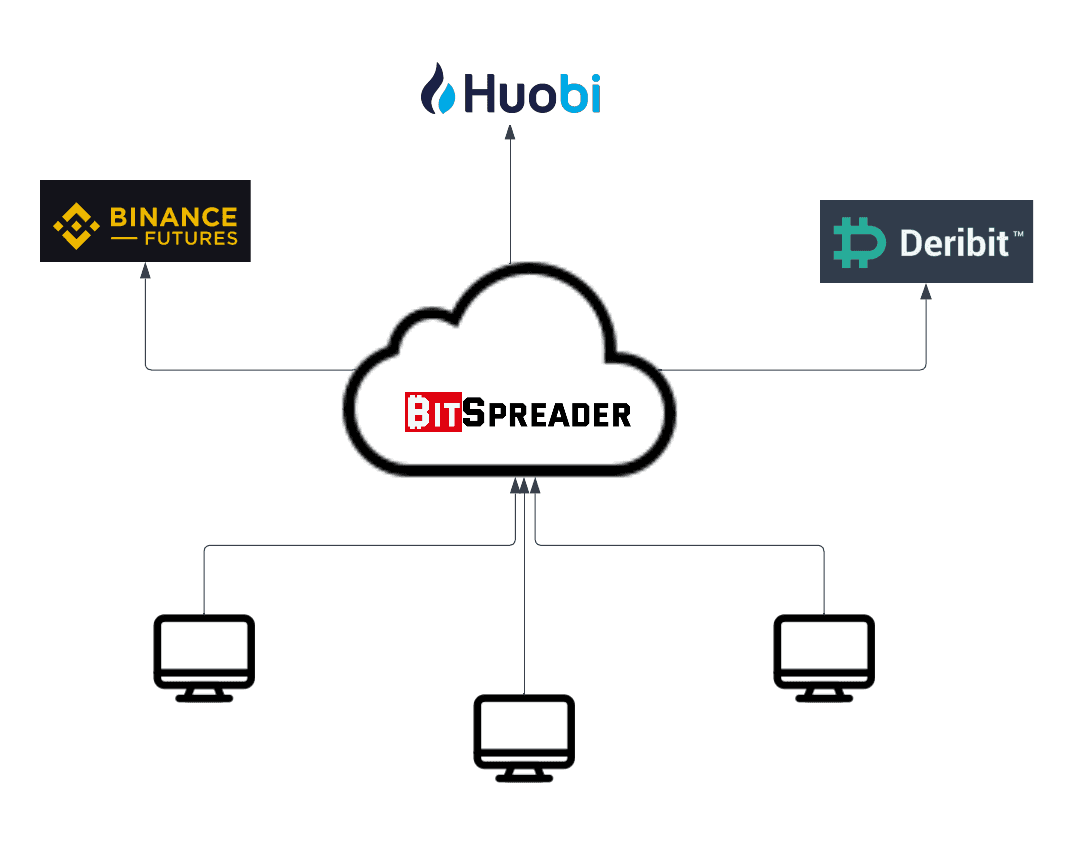

Architecture

Cloud based solution // for best performance

BitSpreader is cloud based solution, user access trading terminal with their browser, no software installation is required.

Users provide their exchange API keys to BitSpreader. BitSpreader uses API keys to execute orders on the exchanges on behalf of the users.

BitSpreader software is available as a subscription-based service.

Streaming spreads

Spread Matrix // with live stream of intra and cross-exchange spreads

BitSpreader provides you with Spread Matrix with streaming cross-exchange and intra-exchange spreads for both ask and bid.

Spread Matrix drives you directly to the spread chart, implied order book and deal ticket for the selected spread

BitSpreader provides three execution types

Market Order

When user requests to execute market buy/sell spread order, BitSpreader simultaneously executes two market orders on the spread legs - outright futures contracts. Buying the spread means buying first contract and short selling the other contract while selling means short-selling the first market and buying the second.

Auto Trigger

User can provide entry/exit criteria for the spread order, platform will execute the order when provided criteria are met - for example user defines auto trigger buy spread with the trigger price equal to 150. Platform monitors the spread price and when it goes down to 150, it executes users spread market order

Auto - Spreading

User provides limit spread price, BitSpreader actively places and updates limit order on one market based on the provided spread limit price and current price on another(hedging) market. When limit order is filled, BitSpreader instantly hedges it by executing market order on another market. This method is the fastest, allows for catching very short lasting spreads and assures lowest fees.

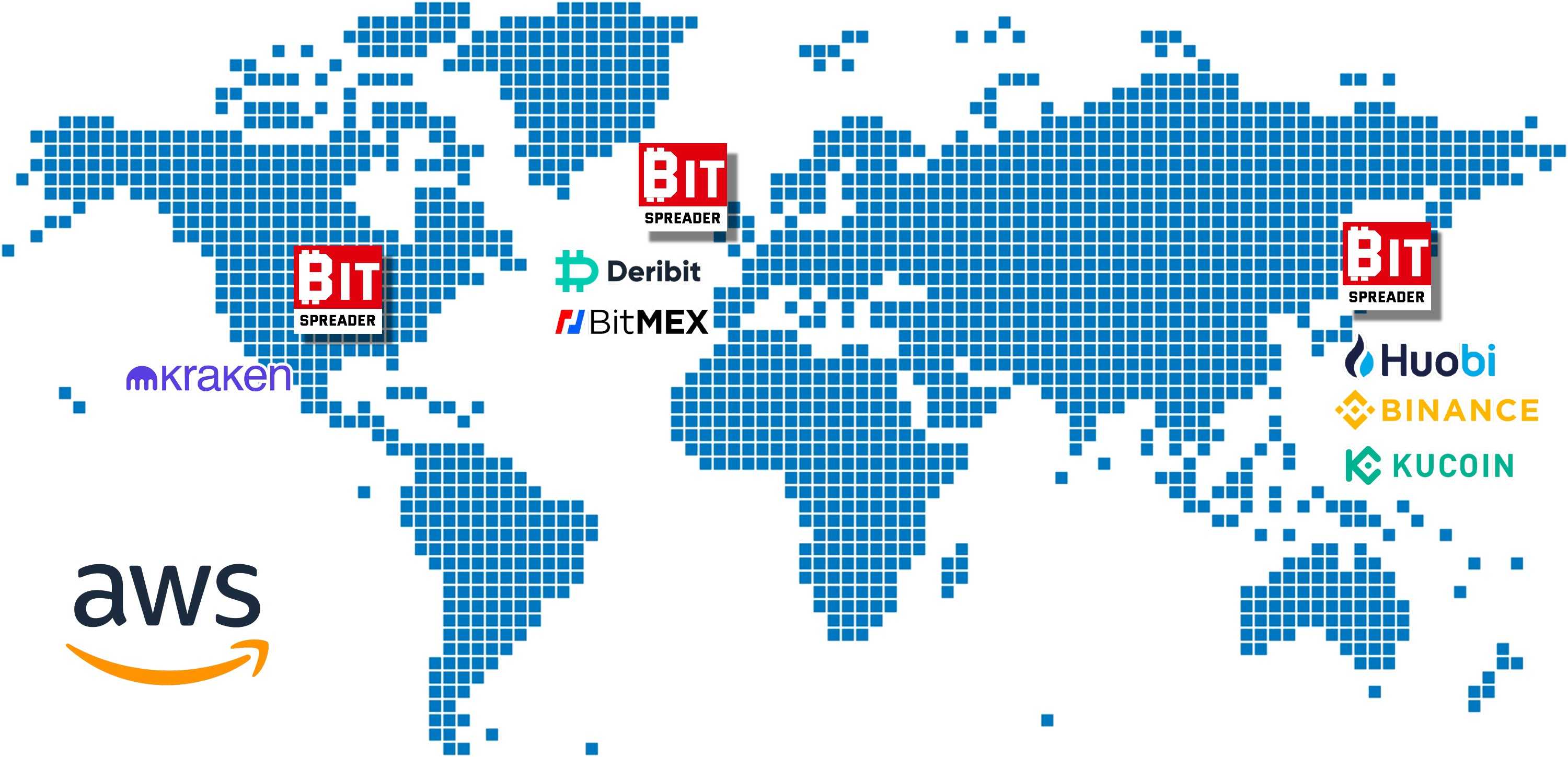

Geographical

Co-Location for

Lightning-Fast Execution Times!

BitSpreader now offers geographical co-location of servers, providing traders with the fastest possible execution times. By strategically placing servers across the world in the United States, Europe, and Japan, users can now choose the location that guarantees the best execution times for their trades. This new feature is designed with the needs of serious traders in mind, ensuring minimal risk of slippage and maximum profits. With BitSpreader's geographical co-location, you can take your trading to the next level and trade with confidence.

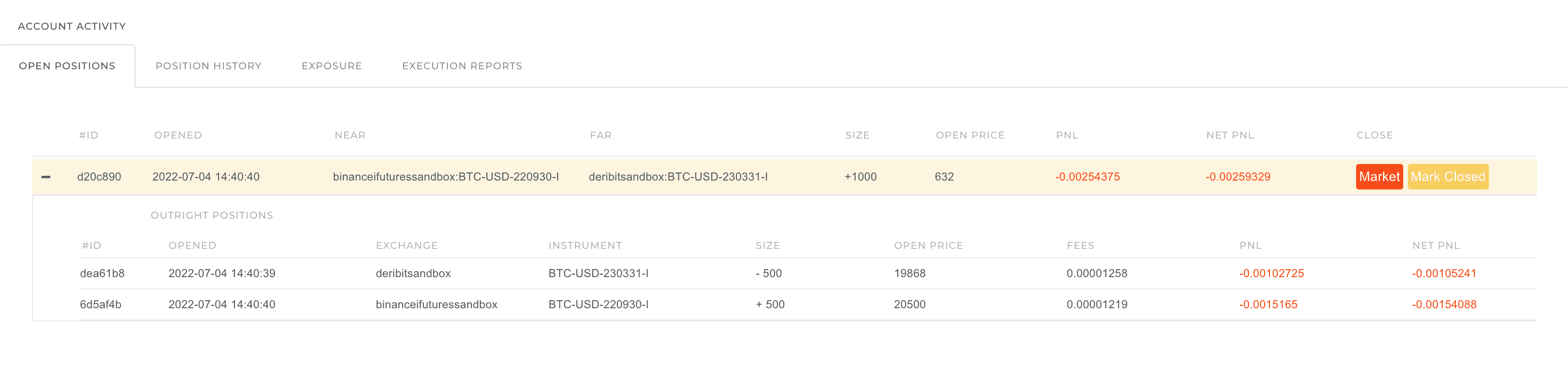

Position & Exposure management

BitSpreader addresses the need to instantly see users summary position constructed out of two outright contracts, including current Profit and Loss and fees on each of the outright contracts as well as on the whole position. Users can instantly market-close the position.

In case one leg of the spread did not execute properly while the other did, the user is exposed for the market risk due to engaging into just one leg of the spread. BitSpreader provides summary & breakdown of the exposure, allowing user to instantly react and close the exposure. The exposure is composed of unhedged legs in form of the internal order book, for which BitSpreader calculates running Profit and Loss.

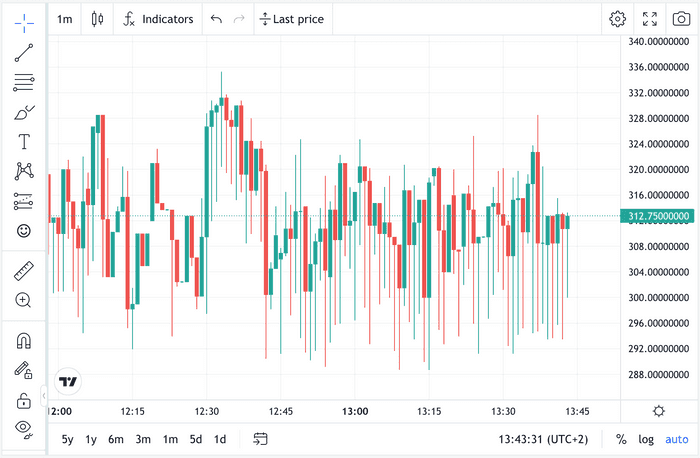

Advanced spread chart

BitSpreader constantly consumes order books from dozens of markets and performs real-time computation of the implied order books of the cross-market spreads. Spreads that have been computed in the real time are recorded for the historical data analysis as the spread charts.

The method that we are using is significantly different from the methods used by our competition - where just the candles representing outright prices are recorded and for the historical analysis the spread chart is computed on the fly by subtracting two sets of candles

YOUR SECURITY is very important to us

We never touch your funds

Your funds are stored safely on your exchange account, BitSpreader just executes orders on your behalf on the exchange using the API key that you have provided.

BitSpreader never does any transfers of your funds.

For further increase of security we strongly encourage you to not provide any API keys that have privilege to execute transfers - please refer to your exchange API key settings to make sure to reduce the API key privileges just to the most necessary (balance, history, trading).

Your data is encrypted

Your API keys are encrypted with highest security standards and available only in the internal layer of the BitSpreader services safely hidden behind the firewalls and not accessible from the website. Encryption keys are safely stored in the digital vault.

For managing your API keys we follow write-only pattern - once you have provided your API key, the BitSpreader has stored it internally for the trading purposes and doesn't expose it even to you for editing. If you need to update the API key - you need to delete the old key and provide the updated one. This approach secures your keys in case you lose access to your BitSpreader account.

Two Factor Authentication is a MUST

In order to further increase your security we require ALL the users to use two-factor authentication. Every time you sign in to the platform you need to provide security code generated by the two-factor application on your mobile phone - ie Google Authenticator or FreeOTP that needs to be set up during the registration process.